National ID mandatory for opening bank accounts

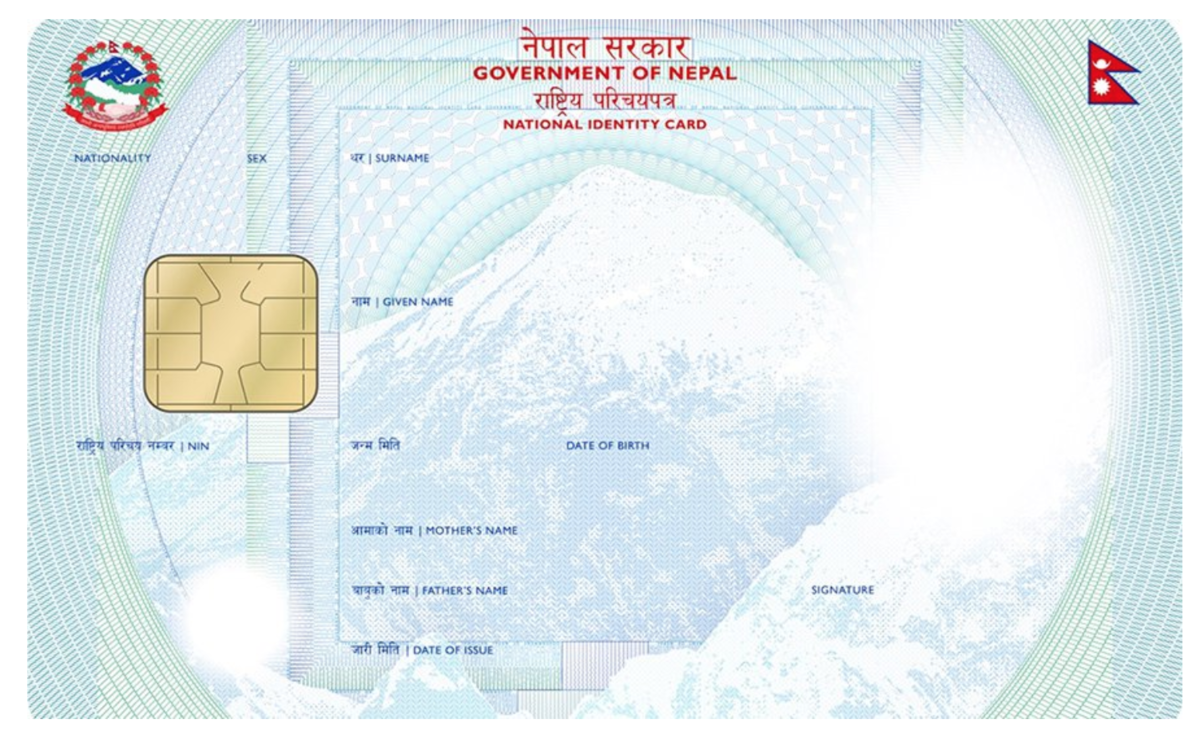

The Nepal Rastra Bank (NRB) has introduced a directive mandating banks and financial institutions to require a national identity card or its number for opening new accounts starting January 14, 2025. Issued on January 9, the directive also requires existing account holders, particularly high-ranking officials, to update their details by the same deadline. However, confusion has arisen as a legal case challenging the mandatory use of national identity cards for public services remains unresolved.

While the directive instructs banks to verify the national identity card details before opening accounts electronically, a follow-up notice from NRB suggested flexibility, stating that banks should “make arrangements” for account openings even without immediate access to the card.

Ramu Poudel, NRB spokesperson explained that customers without their cards could still open accounts, provided they submit the card later, and urged banks to assist individuals facing difficulties obtaining one. This requirement aligns with a government notice published in June 2024, which proposed replacing citizenship certificates with national identity cards for public services, a move that faced legal challenges.

In August 2024, the Supreme Court issued an interim order against the mandatory implementation of national identity cards, and a petition to vacate the order remains pending, with a hearing now scheduled for January 19, 2025. Bankers have raised concerns over the practical difficulties of implementing the directive, citing risks of penalties for non-compliance and challenges in enforcing the rule for customers unable to secure a card. The government’s push to implement the directive is partly driven by international pressure to meet anti-money laundering standards.

Nepal faces a review by the Financial Action Task Force (FATF) and has until mid-2025 to address deficiencies highlighted by the Asia Pacific Group (APG). Failure to comply could result in Nepal being placed on the FATF’s “grey list,” posing significant risks to the country’s financial reputation. The directive, while intended to strengthen financial regulation, underscores the challenges of balancing legal obligations with accessibility to banking services for all citizens.